Product features

A REIT seeking authorization from the SFC must have at least the following characteristics:

- dedicated investments in real estate* that generate recurrent rental income

- must have good marketable legal and beneficial title in real estate owned by the REIT

- not less than 90% of after tax net income shall be distributed to unitholders

- gearing ratio of not more than 50%

- professionally managed by an SFC-licensed REIT manager

- assets held in custody by an independent trustee

- must be listed on the SEHK

* A REIT may invest in infrastructure properties if the requirements in the REIT Code are complied with in substance.

Legal structure

A REIT is a collective investment scheme constituted in trust form. It may also adopt a stapled structure by stapling its units with securities of another listed entity if similar governance and investor protection measures are in place and requirements in the REIT Code are complied with in substance.

Key operators

REIT manager

- Key obligations include:

- manage the REIT in the sole interest of the holders

- ensure that the REIT has proper legal title to the real estate owned by it

- Qualifications of the REIT manager:

- hold a licence for Type 9 regulated activity (asset management)

- possess the requisite competence, experience and resources to carry out its duties

- generally expected to have at least three responsible officers at all times each with at least five years of experience in investment management and/or property portfolio management

-

board of directors consists of at least one-third of independent non-executive directors with a minimum of three

- Key licensing requirements:

- please refer to related FAQs here

Trustee

- Key obligations include:

- fiduciary duty to hold assets of the REIT

- to oversee the activities of the REIT manager

- Qualifications of trustee:

- independent of the REIT manager

- shall be (a) a banking institution incorporated outside Hong Kong or an entity which is prudentially regulated and supervised by an overseas authority acceptable to the SFC, or (b) a depositary licensed or registered to carry on Type 13 regulated activity

- minimum paid-up share capital and non-distributable capital reserves of HK$10 million (or its equivalent in foreign currency)

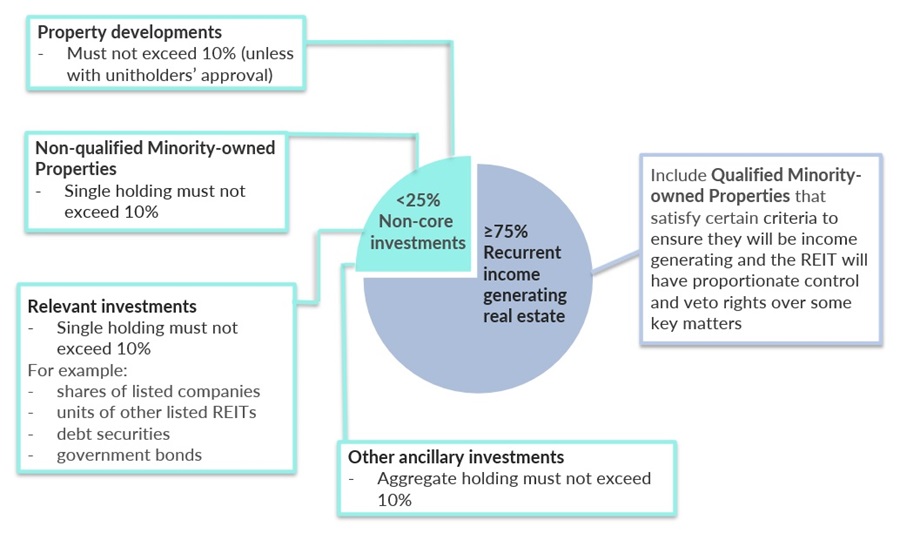

Investment scope

- Under the REIT Code:

- at least 75% of a REIT’s gross asset value shall be invested in real estate that generates recurrent rental income at all times

- non-core investments, including investments in property development projects, shall not exceed 25% of a REIT’s gross asset value

- can invest in minority-owned properties (subject to various conditions)

- There is no restriction on the type or geographical locations of properties that a REIT may invest in:

- may include logistics, data centre, hospitals, infrastructure properties and can be set up with a single property or new properties

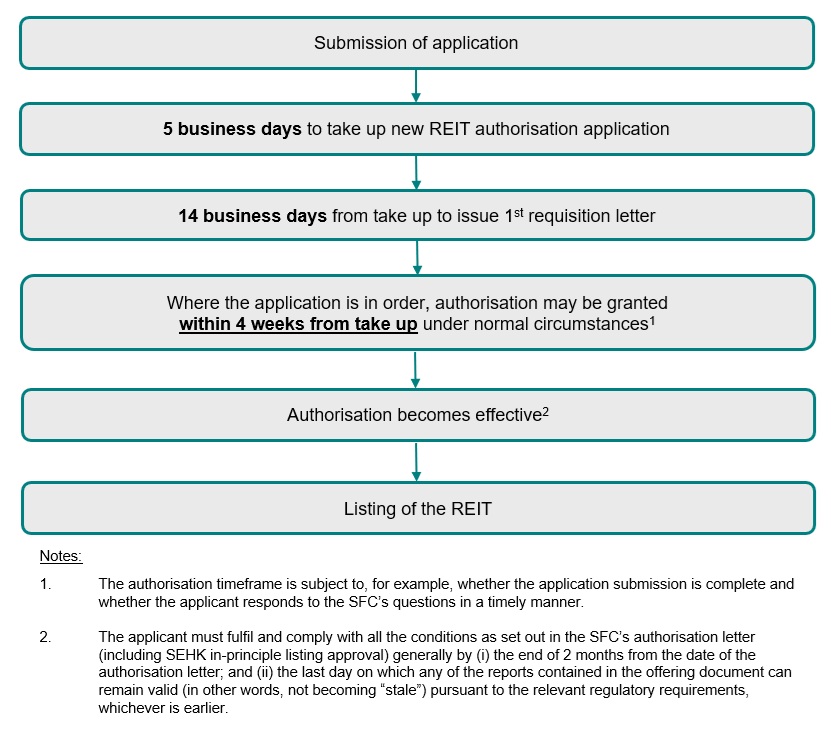

Authorisation and listing process

-

Listing agent(s) must be appointed to assume the role equivalent to a sponsor of an IPO in accordance with the sponsor-related requirements under the Listing Rules.

- The application forms and checklists for REITs are available here.

- Prospective REIT applicants and their professional advisers are welcome to contact the SFC through the REIT Channel via email at REIT_Channel@sfc.hk to consult or seek guidance on specific product or licensing issues regarding their REIT applications on a confidential basis.

Further information

Last update: 13 Oct 2025