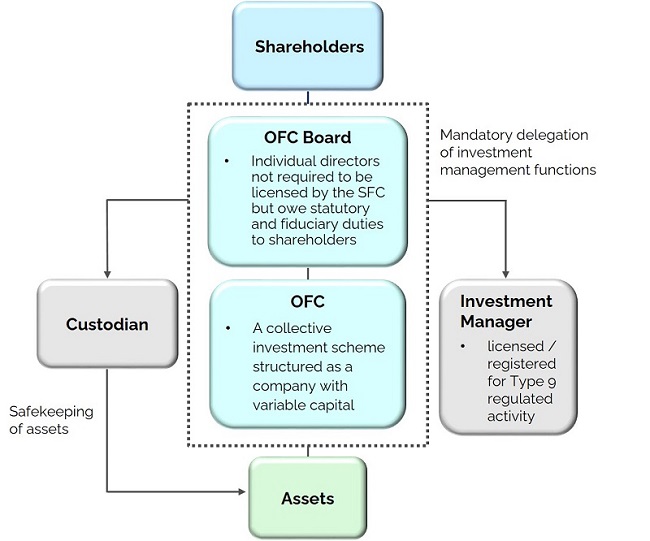

OFC Structure

Directors

- An OFC must have at least two directors, who must be

- natural persons;

- aged 18 or above; and

- not an undischarged bankrupt unless with the leave of the court

- At least one of the directors must be an independent director

- OFC Code provides guidance on independent director, who must not be a director or employee of the custodian

- Directors must delegate investment management functions to the investment manager by an investment management agreement

Investment manager

- An OFC must have an investment manager who is responsible for managing the scheme property of the OFC

- The investment manager:

- must be registered or licensed for Type 9 (asset management) regulated activity; and

- must be and remain fit and proper, at and after the registration of the OFC

Custodian

- An OFC must have a custodian, and all the scheme property of an OFC must be entrusted to a custodian of the OFC for safe keeping

- To be eligible as a custodian of an OFC, an entity must:

- meet same requirements as to the type of entities and capital requirements as those under the Code on Unit Trusts and Mutual Funds (UT Code); or

- for a custodian of a private OFC only, be a licensed corporation or registered institution licensed or registered for Type 1 regulated activity which meets eligibility criteria under 7.1(b)(ii) of the OFC Code

- Appointment of multiple custodians is permitted

Last update: 15 Oct 2021