The introduction of the open-ended fund companies (OFC) structure in Hong Kong is part of the SFC’s initiatives to enhance market infrastructure to further develop Hong Kong as a full-service international asset management centre and a preferred fund domicile. Following completion of the public consultations and legislative process, the OFC regime came into effect on 30 July 2018.

Overview

OFC is an investment fund established in corporate form with limited liability and variable share capital in Hong Kong.

As the primary regulator, the SFC processes registrations and oversees OFCs. The Companies Registry (CR) is responsible for the incorporation and corporate filings of OFCs.

OFCs, whether publicly or privately offered, are required to be registered by the SFC. Same as other publicly offered funds, publicly offered OFCs are also required to obtain prior authorization from the SFC, unless an exemption applies.

Key benefits

- Cost-savings over offshore structure – no duplication of service providers or fees

- Facilitate international fund distribution – corporate structure familiar to overseas investors

- Cater for public and private funds – including listed and unlisted funds, hedge funds, private equity funds and closed-ended funds

- Easy management – no annual returns nor mandatory annual general meetings

- Grant Scheme for OFCs – a Government grant of up to HK$300,000 and HK$150,000 per newly-incorporated or re-domiciled public and private OFC respectively

- Tax incentives – OFCs benefit from Hong Kong profits tax exemptions

How to apply

One-stop establishment – Please submit the requisite documents to the SFC through the e-IP application/submission system on WINGS portal.

Processing time

Private OFC – Successful applications will generally be approved less than one month after take-up of the application by the SFC.

Public OFC – Same as other publicly offered funds seeking the SFC’s authorization, processing of applications for public OFCs will generally take one to three months depending on their complexity. The SFC will process the registration and authorization of a public OFC in tandem.

The SFC’s registration will take effect when the Companies Registry (CR) issues a certificate of incorporation. The CR normally takes three working days to issue the certificate of incorporation for an OFC after receipt of the application documents and fees from the SFC.

Application documents

Please submit to the SFC:

- Application form

- Information checklist, together with the documents (including any confirmations and/or undertakings) prescribed therein

- Instrument of incorporation signed by each of the proposed directors

- Cheques for applicable fees (including the fees payable to the CR)

- Application documents required for incorporation and business registration

If you intend to establish a public OFC, you should also submit the application documents for seeking the SFC’s authorization. The SFC will process the registration and authorization of a public OFC in tandem.

Private OFCs

- Application Form for Registration of a Private Open-ended Fund Company or Establishment of a Privately Offered Sub-fund of an Open-ended Fund Company

- Information Checklist for Application for Registration of a Private Open-ended Fund Company or Establishment of a Privately offered Sub-fund of an Open-ended Fund Company

- Template of Instrument of Incorporation for Umbrella Private OFC

Public OFCs

- Application Form for Unit Trusts and Mutual Funds, Investment-Linked Assurance Schemes and Unlisted Structured Investment Products

- Information Checklist for Application for Authorization of Unit Trusts and Mutual Funds under the Revamped Process

- Template of Instrument of Incorporation for Umbrella Public OFC

For more information regarding the application process, please refer to the FAQs.

Fees

Fees payable to the SFC for registration of an OFC.

- For private OFCs, the application and registration fees are as follows:

| Single fund |

HK$5,000 |

|

| Umbrella fund | Umbrella level | HK$10,000 |

| Each sub-fund | HK$1,250 | |

- For public OFCs, there will be no separate application for registration fee. An application for authorization for a proposed public OFC is subject to the fees for (a) application for authorization and (b) authorization.

| Application fee |

Authorization fee |

||

| Single fund | HK$20,000 | HK$10,000 | |

| Umbrella fund | Umbrella level | HK$40,000 | HK$20,000 |

| Each sub-fund | HK$5,000 | HK$2,500 |

Fees payable to the CR for incorporation and for business registration.

- The fees for incorporation of an OFC are HK$3,034.

- With regards to the application for BR, different fee and levy are applicable for a one-year business registration certificate and a three-year BR certificate, respectively. Please refer to the website of the CR and the website of the IRD respectively for updates as to any fee waiver that may be applicable from time to time.

One-stop establishment of an OFC

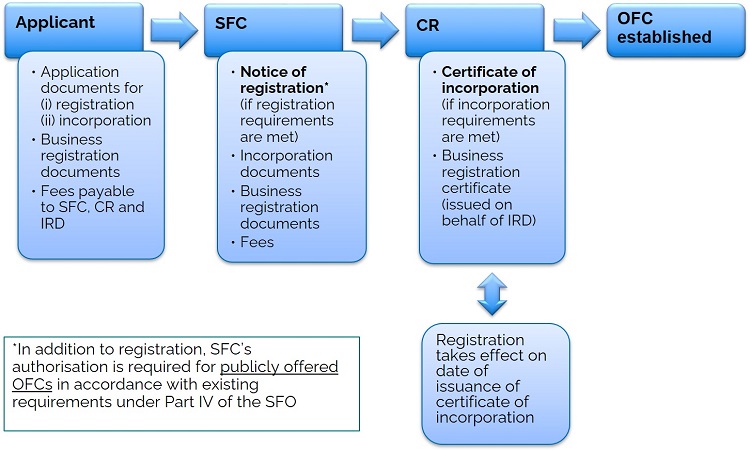

A one-stop approach is adopted for the establishment of an OFC.

- The applicant would only have to submit all application documents required for (i) registration, (ii) incorporation and (iii) business registration and the associated fees to the SFC. No separate submission of documents and fees in respect of (ii) and (iii) to the CR would be required. The documents intended for submission to the CR under (ii) and (iii) should be submitted to the SFC before the registration of an OFC is granted.

- If the registration requirements are met, the SFC will send a notice of registration to CR together with the applicant’s documents and fees for (ii) and (iii). Where the relevant requirements are met, the Registrar of Companies will issue the Certificate of Incorporation and Business Registration Certificate to the applicant.

- The SFC’s registration of the OFC will take effect on the date of issuance of the Certificate of Incorporation, whereupon the OFC would be established.

For details on the CR’s requirements, you may refer to the thematic section on OFCs on CR’s website.

Grant Scheme for OFCs

The SFC administers a grant scheme funded by the Government of the Hong Kong Special Administrative Region to provide subsidies for qualified open-ended fund companies (OFCs) and real estate investment trusts (REITs) to set up in Hong Kong. The grant scheme covers eligible expenses incurred in relation to the incorporation or re-domiciliation of an OFC or the listing of a REIT and paid to Hong Kong-based service providers.

The three-year grant scheme was launched on 10 May 2021 and has been extended for another three years. The extended grant scheme accepts applications from 10 May 2024 until 9 May 2027. Applicants are welcome to consult the SFC about their eligibility before making an application by emailing to grantscheme@sfc.hk or contacting the relevant case officers in charge.

Details

- Frequently Asked Questions on the Grant Scheme for Open-ended Fund Companies and Real Estate Investment Trusts

- Application Form for the Grant Scheme for Open-ended Fund Companies and Real Estate Investment Trusts

- Public Open-ended Fund Companies – Confirmation of Intention to Apply for a Grant under the Grant Scheme for Open-ended Fund Companies

- Terms and Conditions of the Grant Scheme

Re-domiciliation mechanism

A statutory re-domiciliation mechanism is introduced to facilitate the re-domiciliation of overseas corporate funds to Hong Kong using the OFC structure with legal and tax certainty.

The relevant bill has been passed by the Legislative Council in September 2021, and has come into operation on 1 November 2021.

You may refer to the Legislative Council’s website for more information.

Application documents

Click below for more information on OFC:

| OFC structure |

| Regulatory requirements |

| List of registered OFCs |

| Post-registration matters |

| Useful materials |

Enquiries

Enquiries on OFC may be sent to ofc-enquiry@sfc.hk.

Last update: 11 Apr 2025